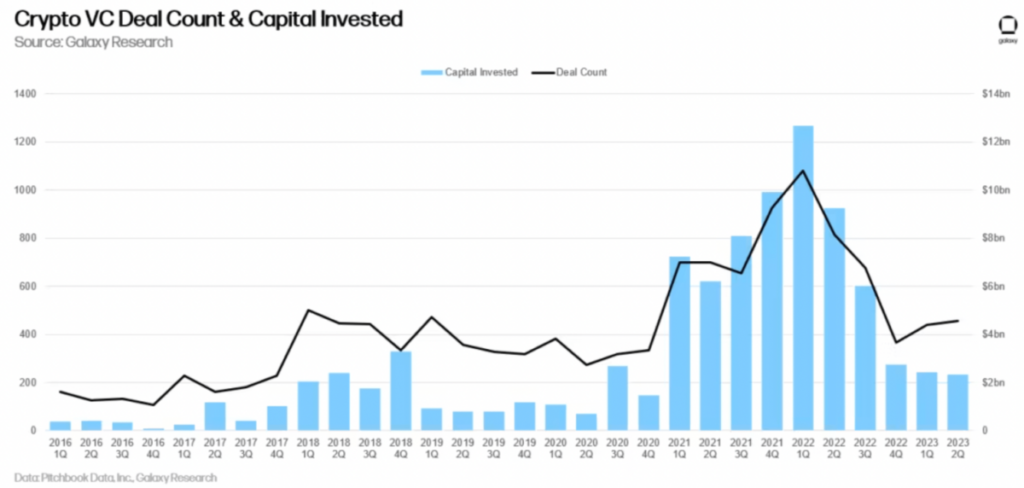

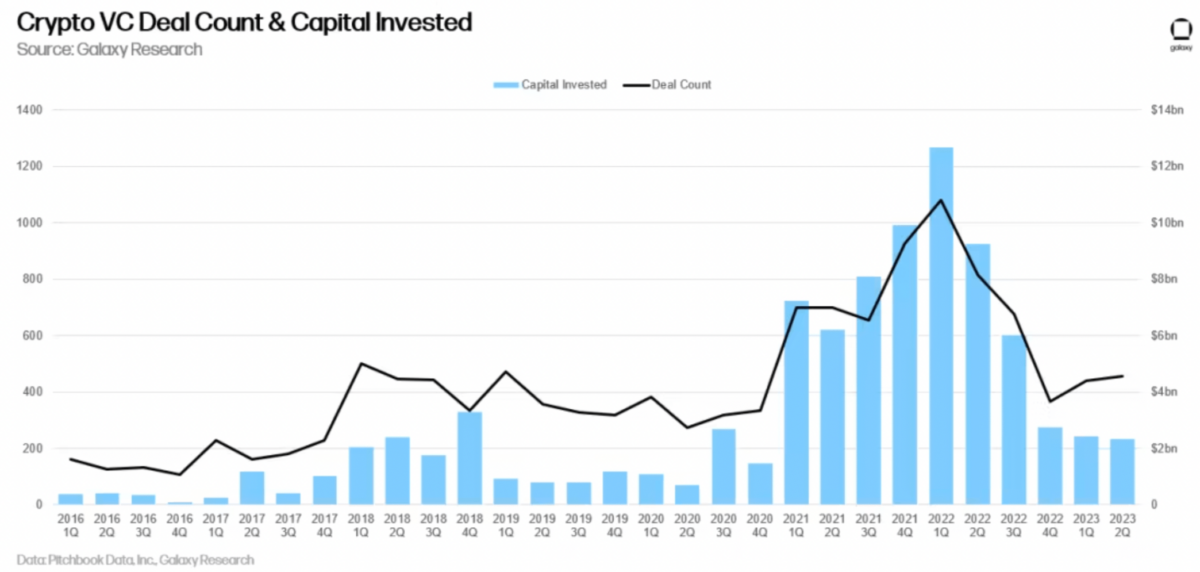

Enterprise capital (VC) funding within the cryptocurrency and blockchain sector is on a downward trajectory, in keeping with a latest report by Galaxy Analysis. The second quarter of 2023 noticed crypto and blockchain corporations receiving $2.3 billion from VC corporations, a major drop from the identical interval final 12 months when greater than $8 billion was invested. Trying again additional to the COVID-19 pandemic, the crypto business skilled a monumental surge in enterprise capital, with a report $13 billion invested in Q1 2022. The present difficult enterprise setting coupled with rising rates of interest has led to a discount in deal movement, in keeping with the report.

“Capital invested has not but discovered a transparent backside. Rising charges proceed to cut back allocator appetites to wager on long-tail danger belongings like enterprise funds,” the report said. This decline marks the fifth consecutive quarter the place VC funding in crypto corporations has decreased. With the digital asset house in its infancy, enterprise capital has continued to play an important function in offering funding to startups in trade for fairness or tokens.

Not all unhealthy information

Apparently, whereas the overall funding quantity has decreased, the variety of offers has barely elevated, rising to 456 from 439 within the earlier quarter. The report additionally famous a major 275% development in offers involving corporations targeted on privateness and safety merchandise, whereas infrastructure-based options got here in at 114 p.c.

By way of sectors inside the crypto house, startups centered on buying and selling, exchanges, investing, and lending attracted probably the most capital, with $473 million invested.

Listed below are the most important offers of the quarter, ranked by sector and business:

- Layer 2/Interop sector skilled the largest deal of the quarter, with LayerZero elevating $120 million Sequence B spherical;

- Companies targeted on Web3, NFTs, Gaming, DAOs, and the metaverse, collectively obtained $442 million;

- The largest deal within the Web3 and NFT house for the quarter was cross-chain NFT market Magic Eden, and its latest $52 million deal.

- Blockchain options supplier Auradine had the largest infrastructure deal at $81 million; and

- River Monetary had the largest Buying and selling/Trade deal at $35 million.

A lightweight on the finish of the crypto tunnel?

Regardless of regulatory challenges, the report means that crypto startups within the U.S. proceed to draw important consideration from enterprise capitalists. This means that the latest regulatory actions by the U.S. Securities and Trade Fee (SEC) haven’t utterly deterred traders.

With Ripple Labs’ small authorized victory towards the SEC during which a decide dominated that gross sales of XRP on exchanges don’t represent a “safety,” and a excessive stage of authorized scrutiny being paid to the SEC’s prior approval of Coinbase’s 2021 S-1 submitting, some within the Web3 house are questioning if the aggressive method of U.S-based regulators might be in for a sea change.

The Galaxy report revealed that 45 p.c of capital invested in crypto corporations was directed at U.S.-based corporations, adopted by the UK at 7.5 p.c, Singapore at 5.7 p.c, and South Korea at 3.1 p.c.

Nevertheless, the lower in VC funding, in keeping with the report, will not be unique to the crypto sector. Tighter financial circumstances have impacted VC corporations’ capability to proceed elevating funds in 2023 for investments throughout numerous sectors, together with the continued bear market coupled with “the spectacular blowups of a number of venture-backed corporations in 2022” which have left many allocators feeling “burned.”

Editor’s word: This text was written by an nft now employees member in collaboration with OpenAI’s GPT-4.