Key Takeaways

- Aptos is a brand new high-throughput Layer 1 blockchain that makes use of a novel good contract programming language known as Transfer.

- The undertaking is taken into account the technological successor of Meta’s deserted blockchain community, Diem.

- Resulting from its said theoretical throughput of 100,000 transactions per second, Aptos has been dubbed a possible “Solana killer.”

Share this text

Aptos is a scalable Proof-of-Stake Layer 1 blockchain that makes use of a novel good contract programming language known as Transfer. The undertaking is developed by Aptos Labs, a blockchain startup led by two former Meta workers.

Aptos Unpacked

Aptos is a Proof-of-Stake-based Layer 1 blockchain that mixes parallel transaction processing with a brand new good contract language known as Transfer to attain a theoretical transaction throughput of over 100,000 transactions per second. The undertaking is the brainchild of two former Meta engineers, Mo Shaikh and Avery Ching, and is taken into account the technological successor of Meta’s deserted blockchain undertaking Diem.

Aptos first made waves within the crypto trade in March this 12 months after it emerged that it had raised $200 million in a seed spherical led by the famend enterprise capital agency Andreessen Horowitz. In July, the startup raised one other $150 million at a $1.9 billion pre-money valuation in a Sequence A funding spherical led by FTX Ventures and Soar Crypto, earlier than its valuation hit $4 billion two months later in a enterprise elevate led by Binance Labs.

It’s value highlighting that Aptos did all this earlier than launching its blockchain, which solely went stay on mainnet on October 17. To reward the early customers of its testnet and pretty distribute the preliminary token allocation, Aptos airdropped 150 APT tokens (value roughly $1,237 on launch) to 110,235 eligible addresses. Per CoinGecko information, Aptos at the moment has a totally diluted market capitalization of round $9.2 billion regardless of launching only some days in the past with little exercise occurring on the community. Past its provenance and hyperlinks to Meta, the undertaking’s valuation has raised questions.

What Makes Aptos Particular?

From a technical perspective, the driving pressure behind Aptos will be boiled down to 2 issues: Transfer, the Rust-based programming language independently developed by Meta, and the community’s distinctive parallel transaction processing talents.

Transfer is a brand new good contract programming language that emphasizes security and suppleness. Its ecosystem comprises a compiler, a digital machine, and lots of different developer instruments that successfully function the spine of the Aptos community. Though Meta initially wished Transfer to energy the Diem blockchain, the language was designed to be platform-agnostic with ambitions to evolve into the “JavaScript of Web3” by way of utilization. In different phrases, Meta supposed for Transfer to turn into the builders’ language of selection for writing secure code involving digital property rapidly.

Utilizing Transfer, Aptos was constructed to theoretically obtain excessive transaction throughput and scalability with out sacrificing safety. It leverages a pipelined and modular method for the important phases of transaction processing. For context, most blockchains, particularly the highest ones like Bitcoin and Ethereum, execute transactions and good contracts sequentially. In easy phrases, which means that all transactions within the mempool—the place all submitted transactions await affirmation by the community’s validators—have to be verified individually and in a particular order. Which means the expansion of the community’s computing energy doesn’t translate into sooner transaction processing as a result of the whole community is successfully doing the identical factor and performing as a single node.

Aptos differs from different blockchains in its parallelized method to transaction processing and execution, which signifies that its community leverages all obtainable bodily assets to course of many transactions concurrently. This results in a lot larger community throughput and transaction speeds, leading to considerably decrease prices and a greater person expertise for blockchain customers. Increasing on this subject in its technical whitepaper, Aptos says:

“To maximise throughput, enhance concurrency, and cut back engineering complexity, transaction processing on the Aptos blockchain is split into separate phases. Every stage is totally unbiased and individually parallelizable, resembling trendy, superscalar processor architectures. Not solely does this present vital efficiency advantages, but additionally allows the Aptos blockchain to supply new modes of validator-client interplay.”

Nevertheless, whereas Aptos claims to have already achieved 10,000 transactions per second on testnet and goals for 100,000 transactions per second as the following milestone, customers ought to take its claims with a grain of salt as they’re but to be battle-tested. Different Layer 1 networks and sidechains making comparable claims, together with Solana and Polygon, have suffered quite a few community outages since their inception and have in any other case been criticized for being too centralized.

Doubtful Tokenomics

On October 17, Aptos triggered vital outrage throughout the crypto group when it launched its blockchain and native governance and utility token APT with out first disclosing its whole provide, distribution, or issuance charge to the general public. After APT’s value plummeted by roughly 40% within the preliminary buying and selling hours, Aptos tried to rectify its mistake and calm the group’s outrage by revealing its tokenomics.

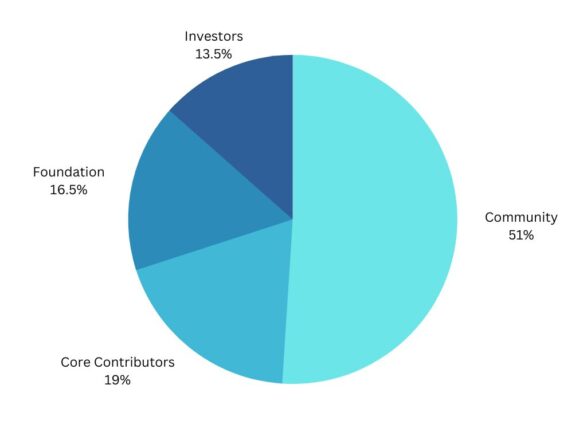

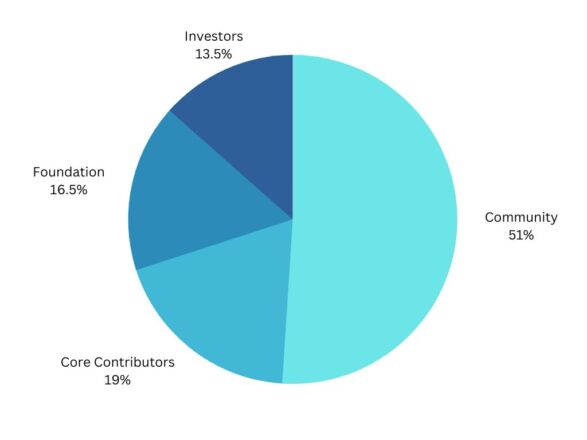

Regardless of the beneficiant airdrop to over 100,000 addresses, the transfer towards transparency was met with much more outrage after the group realized that the whole token provide was allotted to early buyers and the corporate. Specifically, as an alternative of giving the group the 51% of tokens allegedly assigned to it immediately, both by means of airdrops, grants, or staking rewards, Aptos allotted them to Aptos Labs and the Aptos Basis. Furthermore, in line with the staff’s weblog put up, “82% of the tokens on the community are staked throughout all classes,” which means that the corporate and early insiders will earn nearly all of staking rewards which aren’t topic to lockups.

Past that, Aptos at the moment has a circulating provide of 130 million tokens, a complete provide of 1,000,935,772, and an uncapped most provide. In keeping with the official token provide schedule, the inflation charge will begin at 7% and decline by 1.5% yearly till it reaches an annual provide charge of three.25% (anticipated to take over 50 years). The transaction charges will initially be burned, although this mechanic could also be revised by means of governance voting sooner or later.

Is Aptos the Subsequent Solana Killer?

Regardless of working for lower than every week, Aptos has already been heralded as a possible “Solana killer.” That is primarily because of its said throughput of 100,000 transactions per second. For comparability, Solana can solely deal with about 60,000—but it surely suffers network-wide outages frequently.

Past the excessive scalability, Aptos shares different similarities with Solana, together with the sturdy enterprise capital backing and the top-down method to ecosystem constructing. With a battle chest counting a number of billion {dollars} from the get-go and the attract of being the “shiny new factor,” Aptos might very properly steal Solana’s highlight sooner or later if it might develop a thriving ecosystem. In addition to, it ought to definitely assist that Austin Virts, the previous Head of Advertising and marketing at Solana, is now in control of ecosystem constructing at Aptos.

All thought-about, Solana continues to be miles forward of Aptos concerning ecosystem well being and community adoption. By retaining its tokenomics opaque and allocating many of the provide to early buyers and insiders, Aptos started its crypto journey on shaky phrases with the crypto group, which might damage it in the long term. Nevertheless, if Aptos delivers even half of what it has set to attain on the technological entrance, then it has a shot at capturing a major market share from all different good contract-enabled Layer 1 networks.

Disclosure: On the time of writing, the writer of this characteristic owned ETH and a number of other different cryptocurrencies.