Decentralized Finance, generally often called DeFi, is quickly reshaping the panorama of economic transactions and methods in our more and more digital world. This progressive strategy to finance merges conventional financial processes with the cutting-edge expertise of blockchain, providing a extra accessible, clear, and environment friendly monetary system.

On this information, we delve into the query “What Is DeFi”, we goal to demystify decentralized finance, illustrating its significance and influence in as we speak’s monetary and cryptocurrency landscapes.

What Is DeFi?

DeFi, brief for Decentralized Finance, represents a paradigm shift in the best way we take into consideration monetary companies. At its core, DeFi is an umbrella time period for quite a lot of monetary purposes in cryptocurrency or blockchain geared towards disrupting monetary intermediaries.

In contrast to conventional banking methods that depend on establishments like banks and governments, DeFi operates on a decentralized community, usually utilizing blockchain expertise. Because of this DeFi platforms are usually not managed by any single entity and are as a substitute maintained by a distributed community of computer systems.

DeFi encompasses a broad spectrum of economic companies, together with lending, borrowing, buying and selling, funding, and insurance coverage, all with out the necessity for a government. This strategy goals to democratize finance by making these companies accessible to anybody with an web connection, lowering prices, and rising transaction pace and transparency.

DeFi Defined: How It Challenges Conventional Finance

DeFi stands in stark distinction to conventional finance in a number of key methods. Essentially the most notable distinction is the elimination of intermediaries. In conventional finance, banks, brokers, and different monetary establishments act as gatekeepers, controlling entry to monetary companies and infrequently creating bottlenecks. DeFi, nonetheless, makes use of blockchain expertise and good contracts to facilitate direct peer-to-peer transactions, successfully eradicating these intermediaries.

This decentralization affords quite a few benefits:

- Decrease Charges: With out intermediaries charging for his or her companies, DeFi platforms can considerably cut back transaction prices. This value effectivity is especially helpful in cross-border transactions, the place conventional banking charges will be substantial.

- No Central Level Of Management: In conventional finance, centralized methods create factors of vulnerability, the place failure or assault can have widespread repercussions. DeFi’s decentralized nature mitigates this danger, distributing operations throughout a blockchain community, enhancing safety and resilience.

- Accessibility And Inclusivity: DeFi democratizes finance by offering entry to monetary companies to anybody with an web connection, no matter location or standing. That is significantly essential for unbanked or underbanked populations who’ve restricted entry to conventional banking companies.

- Transparency And Auditability: Blockchain’s clear ledger permits for larger visibility into transactions and good contract operations, fostering belief amongst customers.

The Position Of Blockchain

Blockchain is the spine of DeFi. It’s a distributed ledger expertise that data transactions throughout a number of computer systems in a approach that ensures the info can’t be altered retroactively. This expertise permits the creation of good contracts – self-executing contracts with the phrases of the settlement straight written into traces of code. Sensible contracts automate and implement the phrases of an settlement, eliminating the necessity for intermediaries and lowering the possibilities of fraud.

In DeFi, blockchain not solely ensures the safety and transparency of transactions but in addition permits for the creation of decentralized purposes (dApps) that function on this expertise. These dApps present numerous monetary companies on to customers, bypassing conventional monetary establishments and lowering prices. The innovation of blockchain in DeFi represents a major step in the direction of a extra open, inclusive, and environment friendly monetary system, promising to revolutionize the best way we work together with cash.

DeFi In The World Of Cryptocurrency

DeFi inside the cryptocurrency realm is a transformative pressure, redefining the very essence of economic transactions. This house, termed ‘DeFi crypto,’ is characterised by the utilization of cryptographic property to energy a myriad of economic companies historically monopolized by banks and centralized establishments.

Understanding DeFi Crypto

The intersection of DeFi with cryptocurrencies, generally known as “DeFi crypto,” marks a major milestone within the evolution of digital finance. This synergy permits for the creation and administration of economic services and products in a decentralized surroundings, free from conventional banking constraints and centralized management.

DeFi crypto platforms allow customers to lend, borrow, commerce, and earn curiosity on their cryptocurrency holdings in a trustless method. These actions are carried out through good contracts, which autonomously execute the phrases of a contract when sure circumstances are met, thereby eliminating the necessity for intermediaries.

The time period “DeFi crypto” encompasses a variety of purposes and protocols that function on blockchain expertise, permitting for progressive monetary options similar to yield farming, liquidity mining, and decentralized exchanges (DEXs). These DeFi protocols supply customers full management over their monetary property, with enhanced privateness and safety, which is a major shift from the normal finance mannequin.

DEXs are on the coronary heart of DeFi crypto exercise. Uniswap, for instance, stands out as a number one DEX, offering liquidity via an automatic market maker (AMM) protocol moderately than a standard order ebook. It permits customers to swap ERC-20 tokens straight from their wallets, contributing to the pool and incomes charges proportionate to their share. Different DEXes like SushiSwap have adopted go well with, iterating on Uniswap’s unique protocol with further options and incentives.

What Are The Most In style DeFi Blockchains?

Ethereum, extensively often called the main blockchain for DeFi purposes attributable to its early adoption of good contract performance, will not be alone within the house. A number of different blockchains have turn into important DeFi gamers, with their reputation usually measured by Whole Worth Locked (TVL).

TVL in DeFi refers back to the mixture worth of property locked inside a decentralized finance (DeFi) protocol. It signifies the quantity of crypto property, similar to tokens, staked or deposited by liquidity suppliers in numerous DeFi platforms. TVL is an important metric for assessing the general well being and recognition of a DeFi protocol. It helps decide person demand and the protocol’s attractiveness to traders.

Prime-10 Blockchains

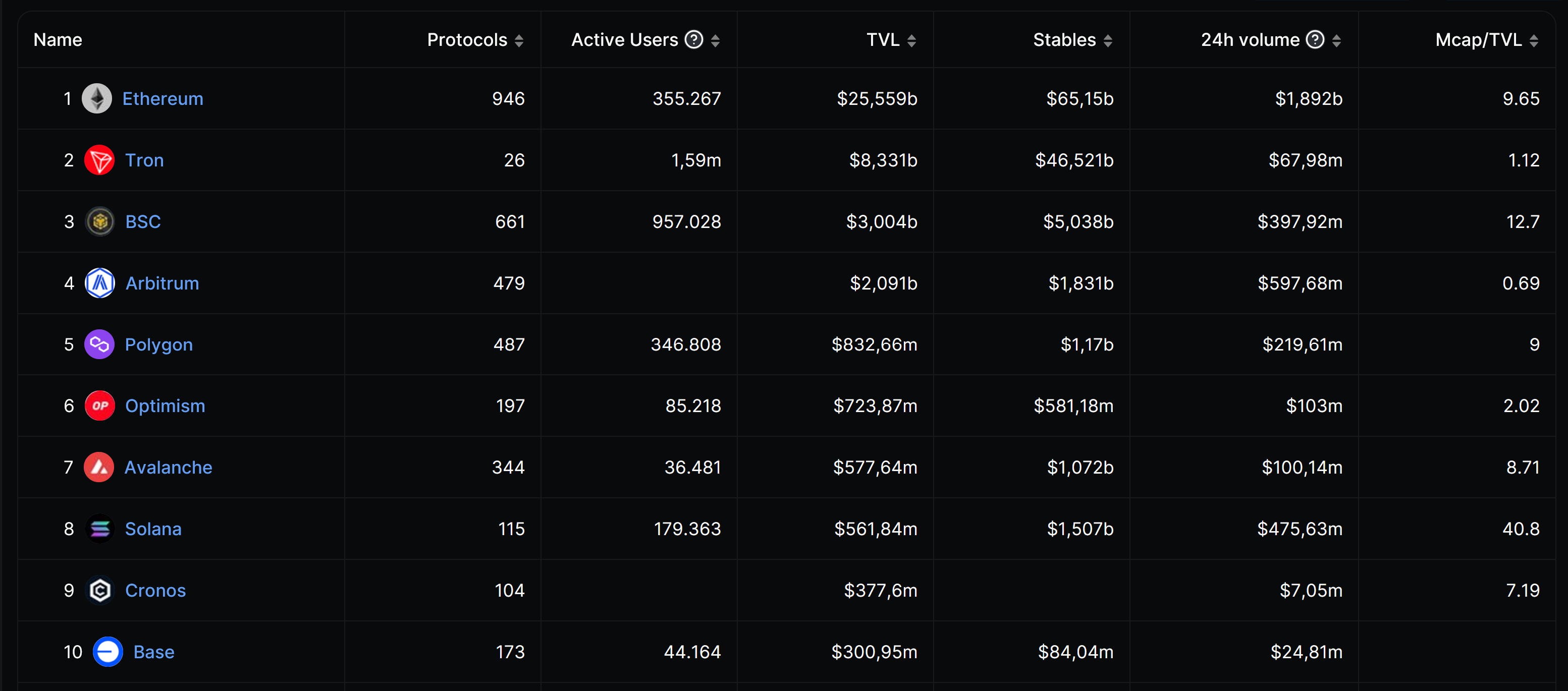

As of November 11, beneath is the listing of the preferred DeFi blockchains primarily based on knowledge from DefiLlama:

- Ethereum: Regardless of excessive fuel charges, Ethereum’s TVL of $25.559 billion and every day energetic customers amounting to 355.267 communicate to its dominance and pioneering position in DeFi. It stays the most important and most generally used blockchain for DeFi, internet hosting quite a few protocols like MakerDAO, Aave, and Compound.

- Tron: Tron’s important TVL of $8.331 billion, coupled with its large 1.59 million every day energetic customers, underscores its reputation, particularly in Asian markets. Its DeFi ecosystem is fueled by excessive throughput and efficient group engagement methods.

- Binance Sensible Chain (BSC): BSC has attracted a substantial variety of customers, with 957.028 every day energetic customers and a TVL of $3.004 billion, attributable to its compatibility with Ethereum’s property and decrease transaction prices.

- Solana: Identified for its pace and low charges, Solana has a TVL of $561.84 million and 179.363 every day energetic customers. It hosts Serum, a high-speed, non-custodial DEX, and different progressive DeFi initiatives that exploit its quick block occasions.

- Polygon: As a scaling answer for Ethereum, Polygon enhances transaction pace and reduces prices, with a TVL of $832.66 million and 346.808 every day energetic customers. It serves as a sidechain that runs alongside the principle Ethereum chain, internet hosting common DApps like QuickSwap and Aavegotchi.

Finest Decentralized Finance Purposes

DeFi is house to a mess of purposes, every striving to supply distinctive and compelling monetary companies. Primarily based on the newest knowledge from DappRadar, right here’s an outline of the highest DeFi purposes, distinguished by their Whole Worth Locked (TVL), which signifies the quantity of capital they’ve secured inside their respective protocols:

- Lido: On the zenith of the listing with a TVL of $18.27 billion, Lido stands out as essentially the most distinguished liquid staking answer. It permits Ethereum holders to stake their ETH whereas retaining liquidity, facilitating participation within the community’s safety with out sacrificing asset accessibility.

- MakerDAO: With a TVL of $5.31 billion, MakerDAO is a trailblazer within the DeFi house. It’s a decentralized credit score platform on Ethereum that manages the DAI stablecoin, pegged to the US greenback, and permits customers to open collateralized debt positions (CDPs) to generate DAI.

- Uniswap V3: Commanding a TVL of $3.57 billion, Uniswap V3 is the newest iteration of the favored DEX, providing improved capital effectivity for liquidity suppliers via concentrated liquidity positions.

- Aave V3: Aave V3 has garnered a TVL of $3.27 billion and is understood for its progressive strategy in decentralized lending. It permits customers to lend and borrow a various vary of cryptocurrencies with various rate of interest choices.

- Aave V2: Previous its successor, Aave V2 holds a TVL of $2.96 billion. It launched options similar to collateral swapping and steady borrowing charges, which have been instrumental in advancing the DeFi lending panorama.

DeFi Staking Defined

DeFi staking is a course of that entails locking up one’s cryptocurrency holdings to help the operations of a blockchain community and, in return, incomes rewards. In DeFi, staking will not be merely a help mechanism for the community, but in addition a approach for customers to earn passive revenue on their crypto holdings. That is achieved via numerous DeFi protocols that provide staking companies.

When customers stake their cryptocurrencies inside a DeFi protocol, they usually switch their property into a sensible contract, which then makes use of these property in numerous community features similar to validating transactions if it’s a Proof of Stake (PoS) blockchain, or offering liquidity. The customers’ staked property assist preserve the safety and efficacy of the platform or community.

In return for staking their property, customers obtain rewards, normally within the type of further tokens. The speed of return can differ extensively, relying on the platform and the demand for the asset being staked. Some DeFi protocols additionally supply further incentives similar to governance rights, the place customers can take part in decision-making processes relating to the long run improvement of the protocol.

Platforms like Synthetix and Curve Finance exemplify DeFi staking. On Synthetix, customers stake SNX tokens to mint artificial property, whereas on Curve Finance, customers stake stablecoins to earn buying and selling charges and CRV tokens. The complexity of staking varies throughout platforms, with some providing easy ‘deposit and earn’ mechanisms, whereas others could require energetic participation in governance or different community actions.

What Is Liquidity Mining?

Liquidity mining is a key idea in DeFi that incentivizes customers to produce liquidity to decentralized exchanges and different monetary purposes by rewarding them with governance tokens. This course of is prime to Automated Market Makers (AMMs), that are on the core of many DeFi buying and selling platforms.

In liquidity mining, customers deposit two property that kind a buying and selling pair right into a liquidity pool. For instance, a person may provide each Ethereum and USDC to the ETH/USDC pool. By offering liquidity, they allow different customers to commerce between these two property extra effectively. The liquidity supplier (LP) will get a share of the transaction charges generated from trades that occur in that pool, proportional to their share of the pool’s whole liquidity.

Past transaction charges, liquidity miners additionally earn further rewards, usually within the type of the platform’s native tokens. These tokens can carry important worth and infrequently grant holders governance rights, permitting them to vote on proposals that may have an effect on the platform’s course and tokenomics. The phenomenon of liquidity mining actually took off with the emergence of Compound’s COMP token, which was distributed to customers who borrowed or equipped property to the protocol, kicking off the “yield farming” craze in the summertime of 2020.

Whereas liquidity mining can supply substantial returns, it’s not with out dangers. Customers can expertise an impermanent loss when the value of your deposited property adjustments. Moreover, good contract vulnerabilities pose a danger, as exploitation of those vulnerabilities can result in a lack of funds.

What Is Yield Farming?

Yield farming, a cornerstone exercise inside DeFi, is an funding technique that entails staking or lending crypto property to generate excessive returns or rewards within the type of further cryptocurrency. This course of, akin to incomes curiosity in a standard financial institution, takes benefit of the intricate incentive constructions constructed into many DeFi protocols.

Traders have interaction in yield farming by including their property to a liquidity pool, which is actually a sensible contract that accommodates funds. In alternate for his or her contribution, members get hold of liquidity tokens, which they will subsequently make the most of to garner further rewards. The DeFi platform usually generates these rewards from transaction charges, or typically they arrive from new tokens launched throughout a promotion.

As an example, protocols like Compound distribute their native COMP tokens to customers who lend or borrow on their platform. Equally, customers who present liquidity to Uniswap’s swimming pools earn a portion of the buying and selling charges along with potential UNI token rewards. These incentives will be fairly profitable, resulting in the fast development and recognition of yield farming inside the DeFi ecosystem.

Notably, yield farming entails excessive complexity and important dangers, similar to good contract vulnerabilities, impermanent loss (a change within the worth of deposited property in comparison with their worth on the time of deposit), and the volatility of reward tokens. But, it stays a well-liked methodology for crypto-savvy customers to doubtlessly develop their holdings by leveraging the DeFi sector’s progressive protocols.

DeFi Defined: Dangers And Rewards

DeFi’s attract is basically attributable to its high-yield alternatives and the democratization of economic companies. Customers can have interaction straight with markets, providing liquidity, borrowing, lending, and incomes potential returns that far surpass conventional banking merchandise. For instance, protocols like Yearn.finance have popularized yield farming, the place traders can earn rewards by staking or lending cryptocurrency property.

But, DeFi will not be with out substantial dangers. One of the vital important dangers comes from good contract vulnerabilities. Excessive-profile incidents just like the hack of The DAO, the place attackers drained $50 million price of Ether attributable to a sensible contract exploit, and the current Poly Community assault, resulting in the siphoning off of over $600 million (although largely returned later), spotlight the potential for catastrophic losses.

Market volatility can result in the fast devaluation of property, as seen within the Could 2021 market crash, the place DeFi markets skilled important stress. Moreover, the absence of a regulatory security internet means there’s no FDIC insurance coverage equal, leaving customers absolutely uncovered if their funds are misplaced or stolen.

What Is The Future Of DeFi Crypto

The trajectory of DeFi crypto is anticipated to be revolutionary, with potential integration into mainstream finance and the creation of extra advanced monetary devices. This integration may see the likes of Aave or Compound doubtlessly working alongside or inside conventional monetary establishments, bringing liquidity and new lending mechanisms to the market.

Nonetheless, the highway forward is fraught with challenges that want addressing. Anticipated adjustments in regulatory frameworks may legitimize DeFi platforms by making certain their compliance with world monetary laws. This might mitigate one of the urgent dangers: the uncertainty and the “Wild West” nature of the present DeFi panorama.

The long run additionally doubtless holds extra superior safety protocols to stop exploits and hacks, which have traditionally plagued platforms like dForce and Harvest Finance, leading to losses price thousands and thousands. Improved safety, alongside enhanced person expertise, may assist in lowering the entry barrier for much less tech-savvy customers, broadening DeFi’s attraction.

One other anticipated improvement is the rise of “DeFi 2.0”, with protocols that deal with the problems of its predecessor, similar to impermanent loss in liquidity swimming pools or the sustainability of yield farming rewards. With these developments, coupled with a attainable enhance in institutional involvement, DeFi crypto stands to redefine not solely how we perceive finance however how we work together with cash in a digital age.

FAQ: What Is Decentralized Finance (DeFi)?

What Is DeFi?

DeFi, or Decentralized Finance, refers to a motion that goals to create an open-source, permissionless, and clear monetary service ecosystem that operates with out central authorities. Blockchain networks host DeFi methods, which use good contracts to supply companies that embody banking, loans, asset buying and selling, and sophisticated monetary devices.

What Is Decentralized Finance?

Decentralized Finance is a time period synonymous with DeFi. It represents the shift from conventional, centralized monetary methods to peer-to-peer finance enabled by decentralized applied sciences constructed on the blockchain.

What Is DeFi Crypto?

DeFi crypto refers to the usage of cryptocurrency inside DeFi methods. It entails the appliance of crypto property to have interaction in monetary actions similar to incomes curiosity, borrowing, lending, and buying and selling via decentralized platforms.

What Is Compound DeFi?

Compound is a DeFi protocol that permits people to earn curiosity on their cryptocurrencies by depositing them into considered one of a number of swimming pools supported by the platform. Furthermore, it additionally permits borrowing of a spread of cryptocurrencies.

What Is DeFi Staking?

DeFi staking entails locking up one’s cryptocurrency holdings inside a DeFi protocol to earn rewards or curiosity.

What Does DeFi Imply?

“Decentralized Finance,” or DeFi, represents monetary companies constructed on open and decentralized blockchain applied sciences, impartial of conventional monetary establishments.

What Does DeFi Stand For?

DeFi stands for Decentralized Finance, encapsulating the thought of economic companies being open to everybody, working autonomously on blockchain, and using good contracts to facilitate transactions.

What Does DeFi Imply In Crypto?

Within the context of crypto, DeFi describes the ecosystem of economic purposes constructed on blockchain expertise, particularly these using good contracts, generally on networks like Ethereum. This setup permits events to conduct quite a lot of monetary transactions straight with one another, eliminating the necessity for centralized intermediaries.

Featured photos from Shutterstock