The fast improve in recognition of the LSDFi protocol will be attributed to its potential to deal with important weaknesses within the DeFi sector. LSDFi gives customers enhanced flexibility and capital effectivity by combining liquidity sensitivity with spinoff farming. Traders are flocking to the protocol, realizing its potential to optimize their earnings whereas minimizing the dangers related to decentralized finance.

Because the DeFi panorama continues to evolve, the rising prominence of LSDFi highlights the ever-increasing want for stylish yield farming choices. $25 million in single-day inflows hitting a file excessive for the protocol demonstrates a powerful perception in its potential for long-term success. It’s anticipated that LSDFi will proceed to draw each seasoned DeFi fanatics and new traders in search of modern methods to maximise their returns.

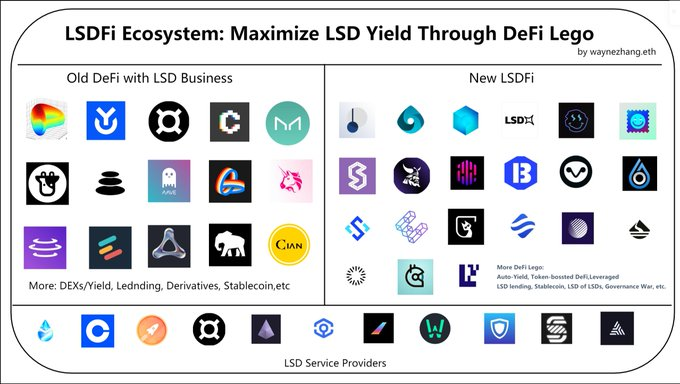

What’s LSDFi?

LSDfi refers to a set of protocols based mostly on LSD. It covers many initiatives, ranging in capabilities from traditional DEXs and lending protocols to extra advanced protocols constructed utilizing distinctive LST properties.

With the widespread adoption of LSD, these protocols will play a vital function in DeFi, laying the inspiration for the DeFi ecosystem, whereas initiatives constructing extra advanced merchandise on high of LSD shall be on the subsequent layer.

LSD has develop into the dominant class in TVL Locked Complete Worth, with Lido being one of the crucial important initiatives. Not solely that, LSD has develop into a typical in any Proof-of-Stake (PoS) ecosystem and has been one of many essential developments in DeFi. LSD gives a constant, low-risk supply of passive earnings and contributes to the upkeep of the blockchain.

Due to this fact, LSD performs a vital function in driving the expansion of the complete DeFi ecosystem. LSDfi serves as a logical extension of LSD, producing economic system as an complete that generates substantial earnings whereas simplifying interactions with LSD initiatives.

The entire locked worth (TVL) of LSDFi exceeds $396 million. This proves that the combination of DeFi and the LSD trade is a major pattern and LSDfi is the results of this evolution. As this pattern develops, LSD is changing into one of many fundamental forces in DeFi. At the moment, LSDfi has grown into an impartial area in DeFi and is making constructive strides. It contains traditional DeFi protocols and extra advanced protocols like Basket Protocol, Stablecoins, Revenue Technique, and extra.

High 6 LSDFi initiatives to sit up for

Lybra Finance(LBR)

The enchantment of Lybra Finance is that it permits holders to obtain stablecoin $eUSD routinely bearing 7.2% APY curiosity in real-time. It provides you with a stablecoin and it’ll multiply in your pockets so long as you maintain it.

To mint $eUSD, it is advisable deposit ETH or stETH, and the protocol distributes the proceeds generated by stETH to $eUSD holders. In different phrases, by depositing ETH or stETH into the protocol and minting $eUSD, you’ll be able to earn about 8.3% APY.

As a result of latest recognition of Lybra Finance on Twitter, the worth of $LBR has skyrocketed, and it is usually attracting increasingly more individuals to obtain rewards by minting $eUSD.

unshETH (USH)

unshETH is a decentralized, on-chain motion to enhance validator decentralization. The matrix prevents monopolies from rising so giant that it stifles innovation and jeopardizes the economic system by changing into a central level of failure via the creation and enforcement of antitrust legal guidelines.

UnshETH’s mission is easy – decentralization via incentives. By way of incentive engineering, UnshETH goals to distribute capital throughout the LSD ecosystem in a method that prioritizes the decentralization of validators.

unshETH is extra worthwhile for smaller validators, and Bettors get increased yields, and ETH is extra decentralized. Consider it as a decentralized most popular revenue aggregator.

Pendle (PENDLE)

Lately, Pendle’s TVL hit an all-time excessive of almost $100 million. Pendle’s thought is to permit customers to make use of their belongings and earnings individually.

In Pendle, the revenue asset is split into Grasp Token (PT) and Revenue Token (YT). PT represents the principal of the yielding funding and YT represents the yield of the yielding asset. YT and PT will be traded on Pendle AMM.

For instance, sending 1 stETH will generate 1 PT-stETH and 1 YT-stETH, the place, 1PT-stETH will be exchanged for 1 stETH and 1 YT-stETH can let you obtain 1 ETH (stETH) when depositing into Lido All of the proceeds.

In case you are a low-risk investor pursuing stability, you should buy PT with earnings eliminated for a hard and fast earnings; if you’re an interest-rate dealer and suppose an asset may go up in value, you should buy YT.

0xAcid (ACID)

0xACID is a protocol that goals to maximise the return of LSD belongings (equivalent to stETH, rETH, frxETH, and so on.) at 4-5% APR. It would considerably affect the complete Ethereum L1 and L2 with the rise of the treasury’s ETH-related belongings.

The protocol holds LSD-related belongings (equal to the long-term upside potential of ETH) and constantly earns actual earnings from Ethereum nodes. All protocol values are in ETH, specializing in ETH development solely, as we firmly consider ETH will attain above $10,000 within the close to future. The treasury will liquidate ETH when it comes $10,000 and ACID holders will obtain an enormous revenue in USD.

Gravita Finance (GRAI)

Gravita Finance is an interest-free lending association with LST as collateral, very like the LSDFi model of Liquity Protocol.

After collateralizing ETH in LSD protocol to obtain rETH, wstETH and different LST, deposit it in Gravita, and in return, you may get stablecoin GRAI. The GRAI stablecoin will also be loaned via Graivta for consumption or deposited into the stablecoin fund to buy liquidated LST collateral at a reduced value.

If the consumer repays the mortgage inside six months (roughly 182 days), the curiosity is prorated, and the minimal curiosity is barely equal to at least one week’s curiosity.

To scale back the volatility of GRAI, a redemption mechanism just like Liquity has been developed, permitting GRAI holders to alternate 1 GRAI for $0.97 value of collateral, incurring a purchase order charge virtually. 3% again.

Index Coop (dsETH)

Index Coop is a DAO-managed protocol that primarily gives customers with structured DeFi merchandise and strategic tokens.

With the present evolution of the LSD and LST protocols, Index Coop gives ETH holders two index tokens to simplify the incomes course of: ETH Variety Staking Index ($dsETH) and Compound ETH Index ($icETH).

With increasingly more LSD protocols showing, it’s tough for some bettors to decide on when it comes to income. Since these LSD and LST protocols are based mostly on the Ethereum mainnet, it may be costly to deposit ETH into a number of LSD protocols or purchase a number of LSTs from the secondary market to diversify investments.

Index Coop addresses this issue by pooling standard LST right into a single ERC20 token, dsETH.

Conclusion

Above are our shares about LSDFi and excellent LSDFi initiatives. In a nutshell, the LSDFi protocol’s one-day historic money circulation of $25 million, with Lybra Finance main the cost with a money circulation of $24 million, is a testomony to the platform’s rising significance within the DeFi house. With a various vary of contributors and a sturdy Complete Locked Worth, LSDFi is poised to form the way forward for decentralized finance, offering customers with a strong software to optimize farming methods and their productiveness.

DISCLAIMER: The knowledge on this web site is offered as common market commentary and doesn’t represent funding recommendation. We encourage you to do your analysis earlier than investing.