Blockchain

Proof-of-stake is a sort of blockchain consensus mechanism that evaluates the crypto stake of taking part nodes when deciding on one for block validation.

However first, why do blockchains want proof of something when validating transactions?

In a sea of nameless members, the community wants a solution to coordinate all well-intentioned gamers. The “proof” is proof {that a} participant met the required circumstances to validate a block of transactions and are appearing in good religion. Our newest information on consensus mechanisms explains how these coordination video games can differ.

Proof-of-stake is sort of a coordination recreation the place gamers compete by proving they’re dedicated to enjoying it perpetually. So long as a protocol’s token has some type of worth outdoors of the community, staking it with a validator is a measure of dedication.

The favored proof-of-stake consensus mechanism is finest recognized for its power effectivity as a result of it changed the power requirement of proof-of-work with token collateral. Peercoin was the primary to make use of the choice mannequin in 2012. And now, over 80 completely different cryptocurrencies are utilizing the consensus mechanism.

Proof-of-stake has just lately shared a bulk of the highlight as Ethereum transitioned from proof-of-work (PoW) to PoS in September 2022. However statements and actions from SEC Chair Gary Gensler have many involved that PoS blockchains are susceptible to safety legal guidelines enforcement.

And as many acquainted with consensus mechanism wars know, there are extra issues and trade-offs that critics argue restrict its capability to supply safety and censorship resistance at scale.

Are these critiques trustworthy, or are they primarily motivated by profit-driven incentives? This text will dig into these issues and consider the benefits the PoS system provides fashionable blockchains.

Why was it invented?

Bitcoin’s creation launched the world to the immense advantages internet-based communities may unlock by means of a distributed ledger. Nevertheless, its limitations with scalability and infrastructure progressively got here to mild as growing numbers of customers adopted the community. Transactions had been gradual and costly throughout peak calls for, whereas issues round its environmental impression emerged as specialised computer systems worldwide started focusing their energy on mining actions.

Somebody within the BitcoinTalk discussion board first launched proof-of-stake as a attainable answer to the computing assets drawback. Sunny King, an nameless writer, and Scott Nadal later carried out it of their revealed whitepaper for Peercoin.

How does proof-of-stake work?

The proof-of-stake consensus mannequin allows coin holders on the community to lock up or commit their belongings in alternate for the ability to confirm and add new transactions to the blockchain. These stakers (known as validators) normally meet a specified threshold of locked cash and obtain new cash as a reward for his or her service to the community.

The first precept behind the PoS mannequin is that people with the best stake within the system have a pure incentive to behave truthfully and preserve the community. Any try at dishonesty may result in substantial losses within the worth of their staked belongings.

Most PoS chain algorithms use a lottery system that selects block validators. The upper the variety of cash the validator has staked, the larger their likelihood of being chosen to create new blocks and earn related rewards.

Community members who can not afford the prices of working a validator node could use numerous staking companies to take part. For instance, Ethereum staking has a lock-up interval, so if a person wished to stake instantly, they’d lose entry to their funds for a time. They will stake with liquid staking platforms comparable to Lido and Rocket Pool if they need entry to their funds earlier than the discharge date. These platforms are decentralized good contracts that stake ETH on customers’ behalf and supply a staking by-product known as stETH in return. Customers obtain rewards in proportion to their stETH holdings. Market forces may cause these derivatives to depeg from the worth of ETH.

Different proof-of-stake blockchains comparable to Cardano wouldn’t have lock-up durations for the delegated stake. So if a person doesn’t wish to run their node, they will delegate their ADA on to a stake pool with out shedding custody.

Each approaches entitle stakers to obtain a portion of rewards earned by the validator. Furthermore, particular implementations, comparable to delegated proof-of-stake (DPoS), select validators for brand spanking new blocks primarily based on the variety of cash group members stake to the validator’s node.

How is proof-of-stake completely different from proof-of-work?

Proof-of-stake differs from proof-of-work in a number of methods. Essentially the most important distinction is when it comes to power utilization. PoS replaces miners with validators, thus eliminating the necessity to expend electrical energy or arrange application-specific built-in circuit (ASIC) machines to confirm and create new blocks.

PoS chains take away the infinite race that usually forces miners to compute the identical transaction whereas just one wins. This results in considerably much less power utilization, as validator choice is predicated on the worth of staked belongings.

The introduction of validators is critical for one more purpose. The worth of the community’s forex is not tied to a real-world asset – power – as within the case of proof-of-work. As an alternative, the forex’s worth primarily relies on financial exercise on the blockchain community. Validators can improve their dominance and earnings by means of accumulation, creating inherent demand for the asset.

One other distinction between a PoW and PoS chain is that the latter usually permits all coin holders to earn rewards by supporting the community’s safety. PoW, then again, solely incentivizes miner participation.

Targets of proof-of-stake

The proof-of-stake consensus mechanism goals to make blockchains sooner whereas lowering the environmental impression of working these techniques. PoS chains can deal with extra transactions per second regardless of consuming considerably much less power. Nevertheless, the mannequin takes a unique strategy to fixing the blockchain trilemma.

The blockchain trilemma is the premise that blockchains can solely provide two of three advantages in reference to decentralization, safety and scalability. Though PoS chains can scale to deal with different mainstream use circumstances, comparable to internet hosting decentralized functions, they’re usually thought-about extra centralized than Bitcoin’s PoW. Each techniques additionally provide a level of safety designed to strengthen as adoption grows.

Proof-of-stake safety

Proof-of-stake blockchains inherit safety by delegating the function of verifying and confirming transactions to its largest stakeholders. Having important financial worth locked in means validators should act truthfully or lose considerably if the ledger’s integrity is compromised. But, even such a system faces the potential for the theoretical 51% assault — the place a malicious particular person or group controls greater than half of the community’s staked belongings and might alter the ledger merely to destroy public religion within the community.

PoS chains take different approaches to mitigate towards a 51% takeover. For example, Ethereum implements “slashing,” a characteristic that enables trustworthy validators to vote towards such malicious transactions and burn the ETH staked by the dishonest actor. This measure disincentivizes dangerous actors, who can simply begin incomes by appearing within the community’s finest pursuits.

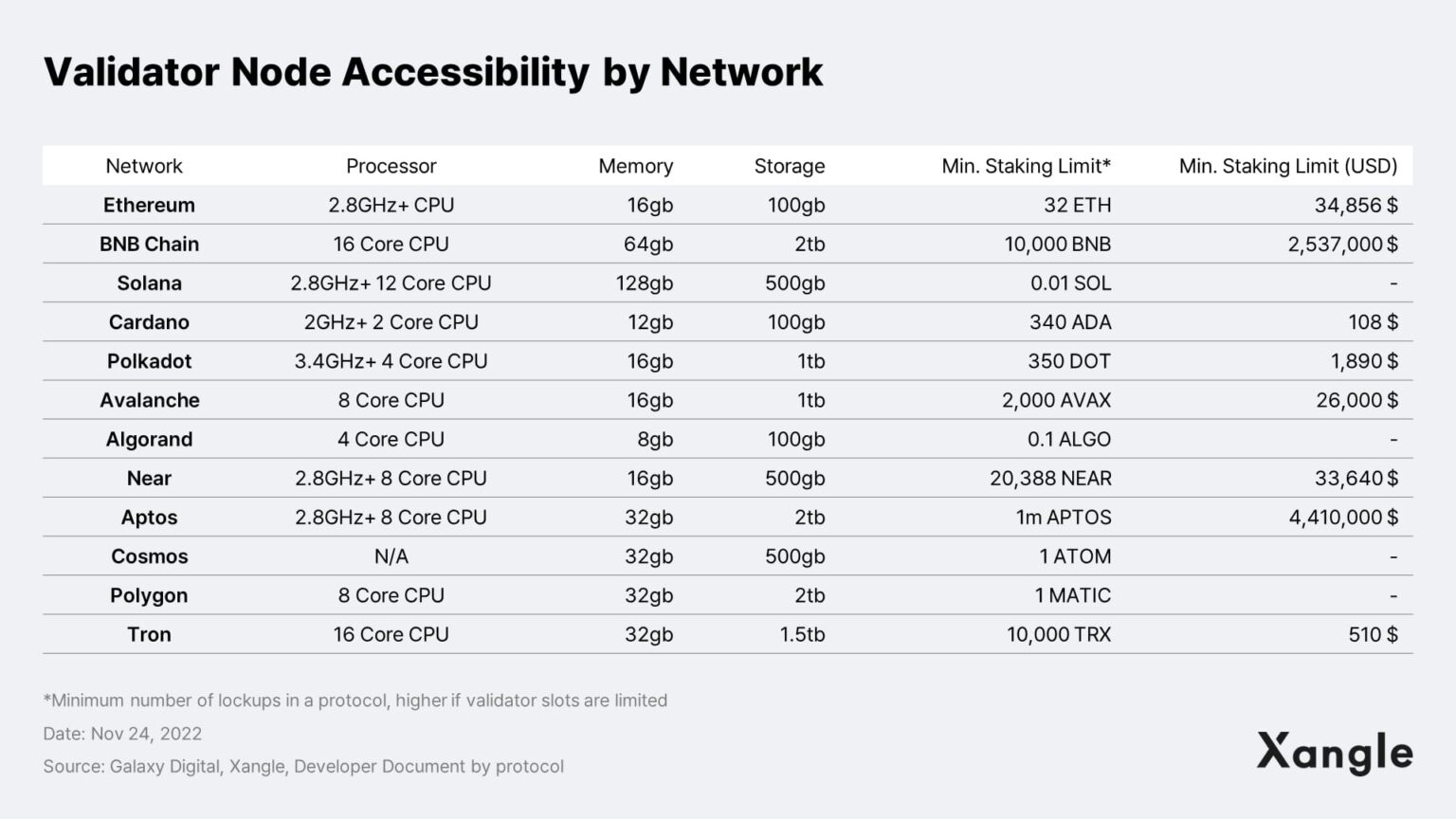

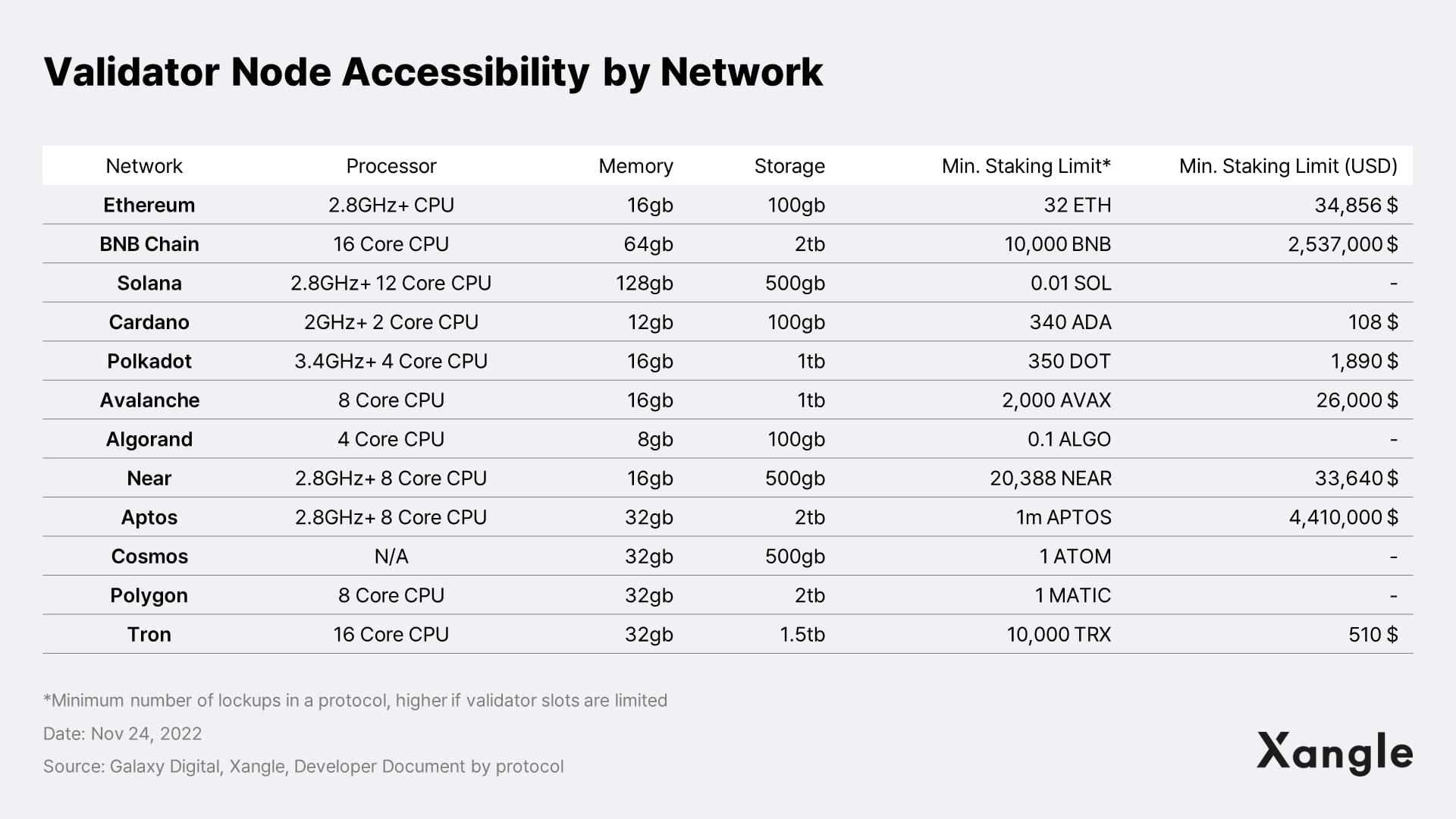

In the meantime, a PoS chain is as safe because the variety of validator nodes. The upper the variety of validators and distribution of staked belongings, the much less prone the community turns into to a safety breach. The necessities for working a validator node differ between completely different PoS chains and should considerably impression the community’s decentralization and safety.

Supply: Xangle

Though the variety of validators on PoS chains tends to scale linearly following the community’s launch, components such because the minimal staking restrict and {hardware} necessities could impede progress. Networks with minimal setup calls for and substantial financial worth obtain larger safety and decentralization in the long run.

Execs and cons of proof-of-stake in crypto

Like different consensus mechanisms, proof-of-stake has distinctive benefits and downsides. The advantages account for its vast adoption throughout the crypto ecosystem, whereas the weaknesses reveal why established networks comparable to Bitcoin proceed to run on PoW consensus.

Execs

- Vitality effectivity: PoS chains are power environment friendly as a result of validators are chosen primarily based on staked belongings or arbitrary necessities comparable to fame and stake length. {Hardware} necessities are additionally comparatively accessible in contrast with working a PoW mining operation.

- Quick and low-cost transactions: Some proof-of-stake chains provide quick and environment friendly transactions, which makes them excellent for decentralized functions and different fashionable blockchain use circumstances. You will need to word that not all proof-of-stake implementations scale back charges. For instance, Ethereum’s transition to PoS didn’t make important modifications to the mannequin (most extractable worth) chargeable for transaction price and velocity. Because of this, the community continues to be susceptible to excessive charges and congestion.

- Flexibility to alter and evolve: Validators can simply vote to change numerous PoS implementations to adapt to the community’s wants. Nevertheless, such modifications are normally difficult to execute on a legacy mannequin comparable to PoW due to technological limitations.

Cons

- Relative infancy: PoS and up to date diversifications to the consensus mechanism are very new and thus unproven over prolonged durations. Fears stay that distinctive vulnerabilities could emerge because the mannequin sees wider adoption.

- Inferior safety: The system stays susceptible since PoS chains tie their worth to the underlying forex as a substitute of a real-world asset. PoS networks should make additional efforts to discourage rich members from shopping for affect. This could improve the protocol’s complexity and make it harder to audit for dangerous habits. PoW chains require power investments which aren’t correlated with the crypto asset. They’re nonetheless susceptible to rich centralized forces. Nevertheless, it’s harder to govern the price of power than crypto.

- Centralization of energy and governance issues: The system additionally tends to grow to be extra centralized because the wealthy perpetually improve their dominance attributable to having a excessive stake within the community. Validators with important holdings also can have an extreme affect on transaction verification.

- Stringent exit guidelines: To fight the benefit at which validators can exit their place, some PoS chains could require locking up staked cash for a minimal period of time – typically with no finish. Such arbitrary guidelines could impose large losses on validators, as they can’t react to market developments.

- Safety legal guidelines enforcement: The SEC made proof-of-stake companies the goal of their enforcement once they charged Kraken for its staking service. Gary Gensler additionally hinted that the protocols themselves could also be a goal when he mentioned the group of entrepreneurs and builders behind protocols with locked tokens “ought to search to come back into compliance.” The SEC additionally listed three PoS tokens — ALGO, OMG and TKN — together with DASH, NGC and IHT, as securities in a lawsuit towards crypto alternate Bittrex. Their argument was extra rooted within the proof of centralizing forces behind every token and the expectation of revenue from token holders. Many argue that staking yield normally constitutes an expectation of revenue – a necessary tenet of the Howey Take a look at.

Learn extra: Will The SEC Goal Crypto Validators and Protocols Subsequent?

Proof-of-stake cryptocurrencies

Proof-of-stake is most cryptocurrencies’ most well-liked consensus mechanism, particularly blockchains centered on internet hosting decentralized functions. On the time of writing, six of the highest 10 cryptocurrencies implement the native PoS mechanism or a modified model. Listed below are the highest PoS cryptocurrencies:

- Ethereum: The second-largest cryptocurrency community, Ethereum migrated to PoS in 2022 as a part of broader efforts to scale its ecosystem. The community had initially operated the PoW consensus mannequin till making the change.

- BNB: Binance-backed BNB Chain implements a modified model of PoS known as proof-of-staked-authority (PoSA). The mannequin is taken into account extra centralized however provides larger scalability.

- Cardano: Launched in 2017, Cardano adopts the native PoS, utilizing its native Ouroboros protocol to find out the following block producer. Though the community’s velocity pales in comparison with opponents, Cardano is mostly thought-about one of many main adopters of the PoS mannequin.

- Solana: The Solana community makes use of PoS alongside different novel protocols to ship extraordinarily low-cost and quick transactions. Notably, the community ranks excessive on the checklist of PoS cryptocurrencies regardless of persistent liveness points.

- Polkadot: Polkadot is one other blockchain challenge that adopts a modified PoS model. The community makes use of a nominated proof-of-stake (NPoS) protocol which selects validators primarily based on previous efficiency.

The way forward for proof-of-stake

PoS chains provide larger power effectivity and scalability options that account for its vast adoption with the cryptocurrency system. But when there isn’t sufficient validator variety, the protocol can undergo from censorship, safety and slashing dangers. These dangers, although, are much like PoW and plenty of different consensus mechanisms.

And whereas PoS companies and tokens have been the goal of regulation by enforcement, it doesn’t imply that coverage is settled. There’s a robust argument for classifying many of those tokens as commodities – so long as they’re correctly decentralized and protocol staking dangers are minimized.

The appearance of the proof-of-stake consensus mannequin has paved the way in which for blockchains to energy a number of use circumstances beforehand unimaginable. These capabilities have already performed a vital function in onboarding mainstream audiences to the blockchain and look set to proceed doing so for the foreseeable future.