In March 2023, the SEC charged eight celebrities with violating sure provisions of the Securities Act of 1933 of their promotion of cryptocurrency belongings. The costs stem from Part 17(b) of the act, an anti-fraud and anti-touting provision that addresses the failure to reveal funds associated to promotional exercise.

The group of celebrities — which included Lindsay Lohan, Jake Paul, and Ne-Yo —particularly confronted accusations of illegally selling Tron (TRX) and/or BitTorrent (BTT) tokens supplied by firms beneath the route of Tron founder Justin Solar.

Whereas the SEC received the case, the questions on the coronary heart of the matter stay unanswered: The place does praising a cryptocurrency finish and selling one start? Can there be such a factor as reliable cryptocurrency promotion? And what determines the standing of the asset as a safety?

Different ongoing authorized battles associated to the unlawful promotion of crypto — together with these involving celebrities endorsing FTX like Tom Brady, Larry David, Stephen Curry, and others — revolve across the similar essential questions. With greater than 20 % of U.S. shoppers proudly owning and utilizing crypto, it’s evident that clear strains have to be drawn when promoting and selling digital belongings.

So, the place is that line? And is there a authorized distinction between merely supporting a particular digital asset and unlawfully selling it?

“Cheap shopper/investor” vs. public determine/celeb

On the most foundational stage, the primary query that needs to be requested is how we outline what it means to “patronize” and assist a specific digital asset — the place a person is merely sharing their funding holding with household, mates, and colleagues —versus what it means to “promote” that specific digital asset to a community-at-large with the particular intent of persuading one other to take a position their cash into that particular person asset.

Patronizing a digital asset isn’t too completely different from an individual merely sharing what shares they personal with a member of the family, buddy, or colleague. On this case, we now have to imagine that the common shopper doesn’t absolutely perceive the mechanics of cryptocurrency, the way it works, and the legal guidelines surrounding it — particularly for the reason that legal guidelines and rules surrounding it are virtually non-existent in terms of the sale and promotion of digital belongings.

So, what’s “tipping” the size of a person harmlessly sharing pleasure a couple of explicit digital asset to taking a considerable step in eager to create an “financial reliance” of such a magnitude that crosses into SEC territory?

It could appear that the particular information and circumstances of the promotion that’s predicated upon the next:

(1) who you might be as an individual/firm,

(2) the assets at your disposal to deliberately talk and promote the asset,

(3) the probability that your message/promotion will attain a big group of individuals, and

(4) the probability that the message/promotion will closely affect a 3rd occasion’s choice in order to create an financial reliance and monetary choice primarily based upon your social standing.

Addressing the primary factor of “who the promoter is,” it might make sense to use a “Cheap Particular person” customary, which might draw the road of whether or not we’re speaking about an on a regular basis shopper (skilled or novice) or a public determine/celeb, which carries extra weight and tasks.

Typically, it might seem {that a} cheap, common shopper who’s supporting and sharing their funding into a specific digital asset is (most often) unlikely doing it for the expectation of serving to improve the ground worth or market worth of that specific asset.

#TRX 🚀 @justinsuntron https://t.co/xh6xB6fNmo

— Jake Paul (@jakepaul) February 13, 2021

A public determine or celeb, however, has by and thru their “public” standing a uniquely highly effective capability to speak at giant a message or concept that has a really sturdy probability of persuading huge quantities of individuals to behave or behave in a sure method – no matter how skilled or well-versed they’re in with the ability to convey such a message precisely.

Because of this, figuring out who is definitely selling the digital asset is essential in assessing the “why” behind their promotion and whether or not it constitutes an “unlawful promotion” beneath present securities legislation.

The “appear and feel” of the promotion

One other essential side of figuring out the distinction between patronizing and selling is the “appear and feel” of what’s being shared. We’ve seen the SEC come down exhausting on celeb endorsements of digital belongings that in the end communicate to the appear and feel of the celeb’s promotion of a cryptocurrency, together with the verbiage and nature of the disclosures particularly expressed within the publish.

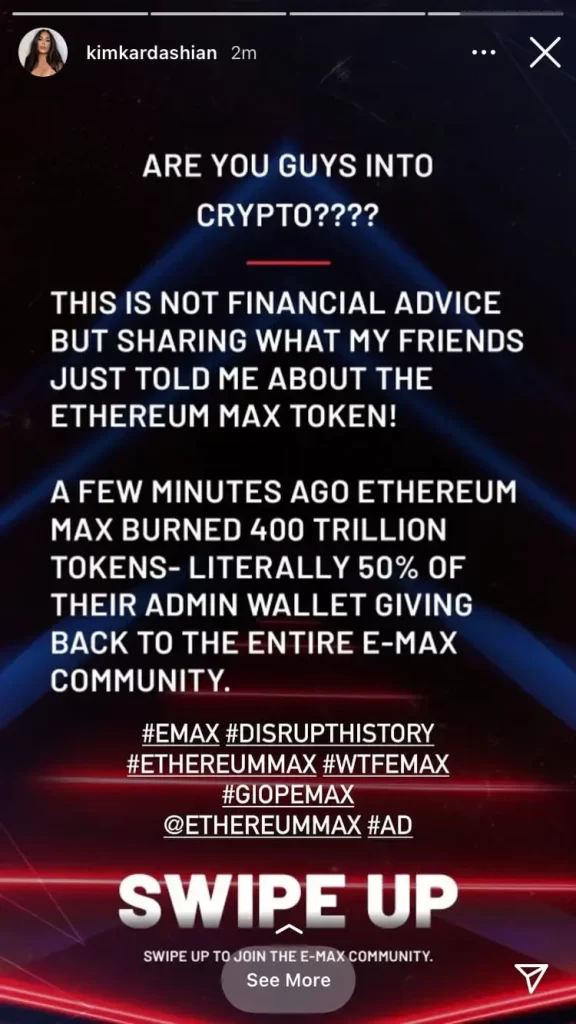

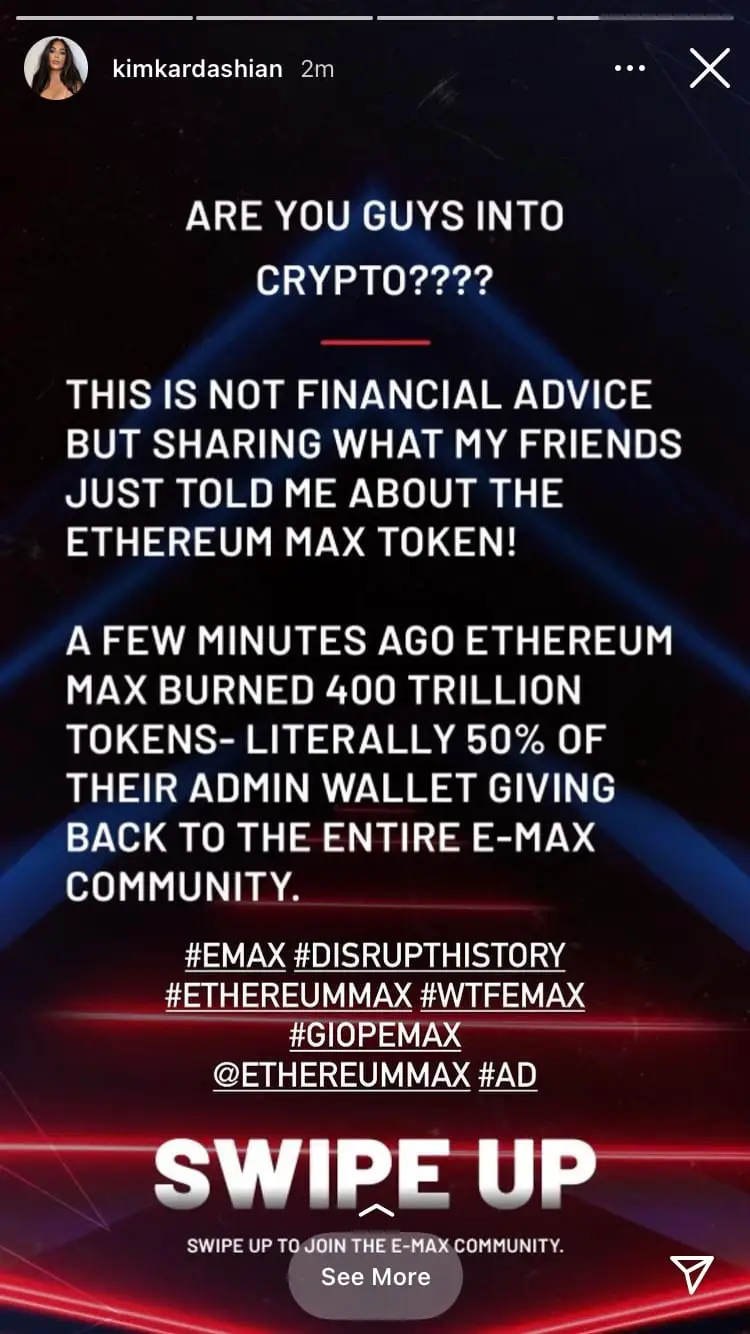

This started in October 2022 with Kim Kardashian and her unlawful promotion of EthereumMax (EMAX).

Whereas Kardashian agreed to settle the fees, paying $1.26 million in penalties, disgorgement, and curiosity, the SEC discovered that Kardashian had didn’t disclose that she was paid $250,000 to publish a publish in 2021 on her Instagram account (which now has 359M followers) about EMAX tokens.

Her publish contained a hyperlink to the EthereumMax web site, which supplied directions for potential buyers to buy EMAX tokens, however nothing else. Whereas Kardashian had said in her publish that it was “not monetary recommendation” along with including completely different hashtags together with “#advert,” the SEC stated that wasn’t sufficient for compliance.

Different celebrities focused by the SEC included Floyd Mayweather, Jr., DJ Khaled, Lindsay Lohan, Jake Paul, Soulja Boy, Akon, Ne-Yo, and Lil Yachty for a similar causes.

thanks guys, purchased some BNB, DGB, TRX, KLV, ZPAE and FDO 💪🏾 what’s subsequent? let’s go ✔️

— Soulja Boy (Draco) (@souljaboy) January 22, 2021

Then, in November 2022, FTX declared chapter, resulting in the collapse of the change and one of many largest monetary scandals since Enron and Bernie Madoff.

From Tom Brady, Madonna, and Gwyneth Paltrow to David Ortiz, Larry David, Jimmy Fallon, and extra, the SEC introduced its costs as FTX’s collapse continued to unwind whereas additionally showcasing the necessity for public figures to make the correct disclosures on their social media posts and TV ads that they’re getting paid to advertise these digital belongings.

This was a reminder and warning to celebrities and different public figures that they can not escape the necessities of the anti-touting provision of Part 17(b) of the Securities Act of 1933, which requires them to open up to the general public when they’re getting paid to advertise one thing, how a lot they’re getting paid to advertise investing in securities.

Beneath Part 17(b), a “promoter” is prohibited from publishing or circulating an article or communication for ‘a consideration acquired’ with out absolutely disclosing that consideration. Beneath the legislation, a “consideration” is a mutual change of worth that helps solidify the enforcement of a authorized contract or settlement.

Navigating the unknown

Sadly, there may be nonetheless a grey space in regards to the anti-touting provisions of Part 17(b), as a result of it solely applies if the instrument being promoted is a “safety.” And we nonetheless don’t have clear steering on what constitutes a “safety.”

This brings us to the current sudden crackdown by the SEC towards two of the world’s largest crypto exchanges and the continued debate and controversy surrounding the SEC’s “enforcement by regulation” strategy that’s enormously harming the expansion and improvement of the {industry}.

Senator Cynthia Lummis (R-WY), who, along with Senator Kirsten Gillibrand (D-NY), has been a powerful advocate for the institution of a whole regulatory framework, took to Twitter to share her adamant belief that the SEC has “failed to offer ample authorized steering on what differentiates a safety from a commodity.”

My assertion on the SEC suing Coinbase, inc. https://t.co/5KNEM0IPSV pic.twitter.com/EgRIxrIcjj

— Senator Cynthia Lummis (@SenLummis) June 6, 2023

Each she and Senator Kirsten Gillibrand (D-NY) have been the driving drive behind their proposed, landmark bipartisan laws – the Accountable Monetary Innovation Act, that might create a whole regulatory framework for digital belongings that encourages accountable monetary innovation, flexibility, transparency, and sturdy shopper protections whereas integrating digital belongings into current legislation – equivalent to Howey.

The landmark 1946 U.S. Supreme Court docket case of Howey is the guts of any conventional securities evaluation, presenting components that should be thought-about in serving to decide whether or not an instrument is taken into account a “safety” or “funding contract.”

An industry-wide gray space

Because it stands, this {industry} is working within the grey by way of how they introduce a digital asset to its buyer base and the mechanisms underlying its buy and sale of them, together with the strategies they use to advertise and/or in any other case promote the asset providing.

The pending litigation that we’re watching unfold will unquestionably deliver these circumstances entrance and heart, starting with what standards makes a digital asset or providing a “safety” (versus a commodity) and the way an organization or model is ready to legitimately promote that asset or providing to buyers and most people with out violating securities legislation.

The knowledge supplied on this article doesn’t, and isn’t meant to, represent authorized recommendation; as an alternative, all data, content material, and supplies obtainable on this website are for common informational functions solely. Data on this web site could not represent probably the most up-to-date authorized or different data. This web site incorporates hyperlinks to different third-party web sites. Readers of this text ought to contact their lawyer to acquire recommendation with respect to any explicit authorized matter. No reader, consumer, or browser of this website ought to act or chorus from appearing on the premise of data on this website with out first in search of authorized recommendation from counsel within the related jurisdiction.