With the fourth Bitcoin halving simply 12 days away, the group is buzzing with anticipation, speculating on the potential for Bitcoin to breach the numerous $100,000 threshold. Joe Consorti of Theya Analysis has supplied a complete evaluation, diving into the intricacies of Bitcoin’s present market place and the components which may catapult its worth to new heights.

This occasion, a cornerstone in Bitcoin’s design to halve the rewards for mining new blocks each 4 years, traditionally triggers a bullish momentum, and the current situation seems to be aligning with previous precedents.

The Significance Of Bitcoin’s Consolidation Section

Consorti’s analysis titled, “Bitcoin’s 4th Halving Is [12] Days Away, and $100,000 Isn’t A lot Additional Behind It”, begins with a deep dive into Bitcoin’s ongoing consolidation part, which he argues is a important interval that precedes a possible bull run.

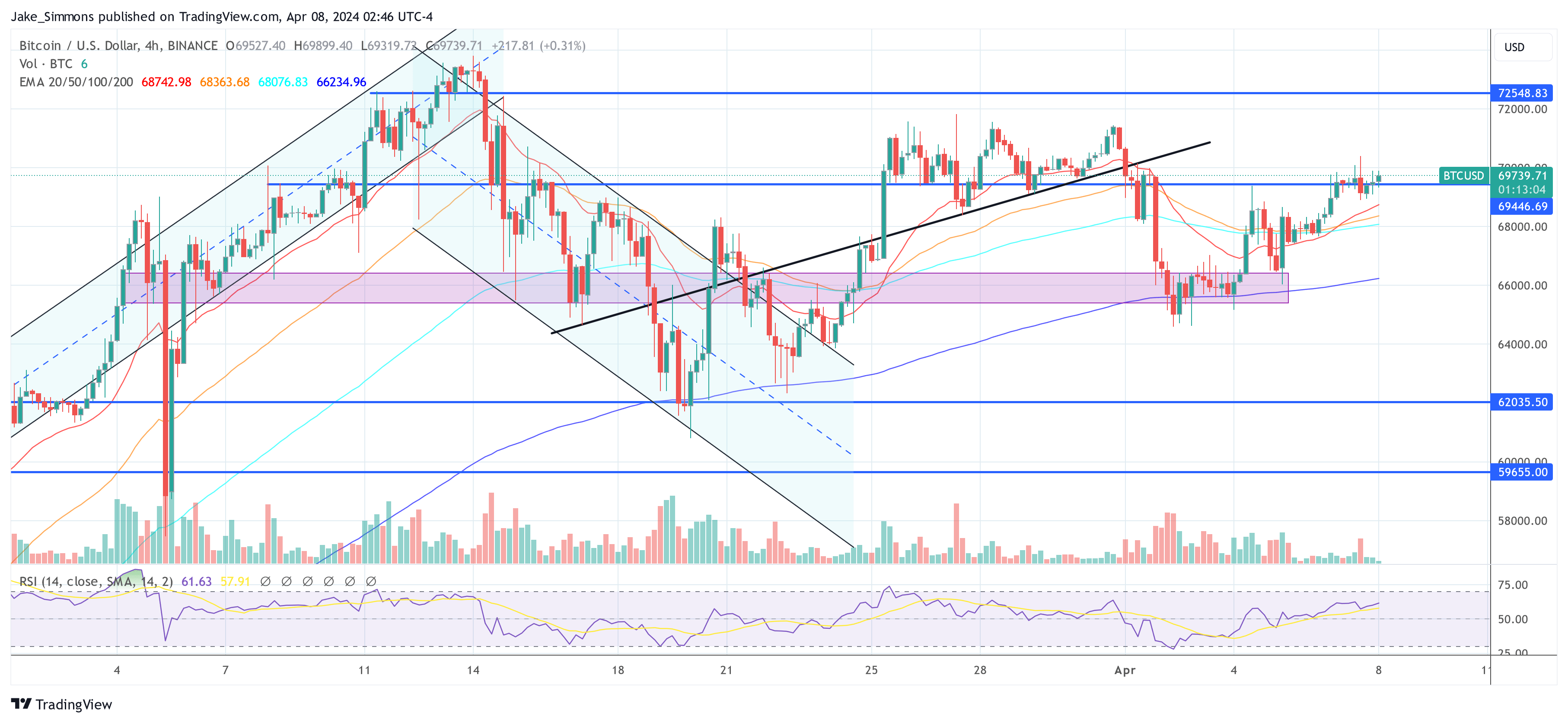

“Bitcoin continues its consolidation. Consistent with its earlier phases of consolidation at $30k and $40k, BTC spends a number of weeks at key psychological worth ranges exchanging fingers between patrons and sellers earlier than advancing greater,” Consorti said on X.

He emphasizes that that is the sixth week of Bitcoin’s consolidation above $60,000, marking the least risky interval at this worth stage and following a brand new all-time excessive. This, in accordance with Consorti, alerts a powerful market confidence that may very well be the inspiration for the subsequent surge.

The evaluation additional explores the broader market dynamics, significantly the correlation breaks throughout the present cycle which have made the inventory market an unreliable indicator of US financial sentiment. “The market at massive has skilled huge correlation breaks this cycle […] This has an incredible deal to do with companies extending their debt maturity throughout 2021 when charges have been nonetheless low, and the US Treasury’s huge crisis-level fiscal deficit,” Consorti explains.

He argues that these components have contributed to the decoupling of conventional financial indicators from the inventory market’s efficiency, inadvertently benefiting asset costs, together with Bitcoin.

The Position Of ETFs And The Spot Market

A good portion of Consorti’s evaluation is devoted to the conduct of Bitcoin ETFs and their interplay with the spot market.

Regardless of a slowdown in web inflows to Bitcoin ETFs, the quantity stays strong, indicating a wholesome market. “This was one of many lowest weeks but for BTC ETF inflows, though if you web within the outflows they’re nonetheless wholesome in comparison with earlier weeks,” Consorti notes, suggesting that ETF shares are actively exchanging fingers, mirroring the consolidation seen within the spot market.

This interaction between ETFs and the spot market, in accordance with Consorti, gives a secure basis for Bitcoin’s worth, additional solidifying the case for an impending bull run. “The funding fee is extraordinarily muted, and we’re nonetheless on the similar worth [around $70,000]. On this interval of consolidation, the spot market has actually taken management of Bitcoin worth motion. This may imply extra secure footing for the following bull run, elevating my confidence additional that this consolidation is previous a transfer greater fairly than decrease,” Consorti concluded.

Professional Consensus On The Bullish Outlook

Consorti’s optimistic forecast is echoed by different business specialists, who’ve additionally shared their bullish predictions. CRG, one other famend analyst, emphasised the importance of Bitcoin’s latest efficiency, stating, “Nice weekly shut. Recent all-time highs this week,” indicating a constructive momentum that may very well be sustained within the post-halving interval.

Nice weekly shut

Recent all time highs this week

Supply: my plums pic.twitter.com/wyxwomdDjZ

— CRG (@MacroCRG) April 8, 2024

TechDev, a crypto analyst, highlighted a uncommon sample in Bitcoin’s buying and selling historical past: “It doesn’t occur typically. Bitcoin closed 2 consecutive months over the higher Bollinger band. Every time it has then doubled inside 3 months earlier than the subsequent pink candle.” This historic sample, if repeated, might probably drive Bitcoin’s worth approach past $100,000.

It would not occur typically.#Bitcoin closed 2 consecutive months over the higher Bollinger band.

Every time it has then doubled inside 3 months earlier than the subsequent pink candle. pic.twitter.com/veOOOmT8Id

— TechDev (@TechDev_52) April 7, 2024

Daan Crypto Trades supplied a technical perspective, specializing in Bitcoin’s resistance ranges and potential targets: “Thoses earlier ‘resistances’ didn’t find yourself placing a lot of a battle. It’s simply the earlier all-time excessive that’s making the value stall in the intervening time. Targets above are concepts for worth discovery if we are able to go away this space behind us.” Daan’s targets are the 1.272 Fib at $83,562, the 1.414 Fib at $91,164 and the 1.618 Fib at $102,085.”

#Bitcoin Excessive Timeframe Degree Cheat Sheet

Thoses earlier “resistances” did not find yourself placing a lot of a battle. It is simply the earlier all time excessive that is making worth stall in the intervening time.

Targets above are concepts for worth discovery if we are able to go away this space behind us. https://t.co/AeP9vzOk7M pic.twitter.com/BWvcg8EjLE

— Daan Crypto Trades (@DaanCrypto) April 7, 2024

At press time, BTC traded at $69,739.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site totally at your personal threat.