- BNB’s open curiosity has climbed by double digits prior to now 11 days.

- This places the coin at liquidation danger.

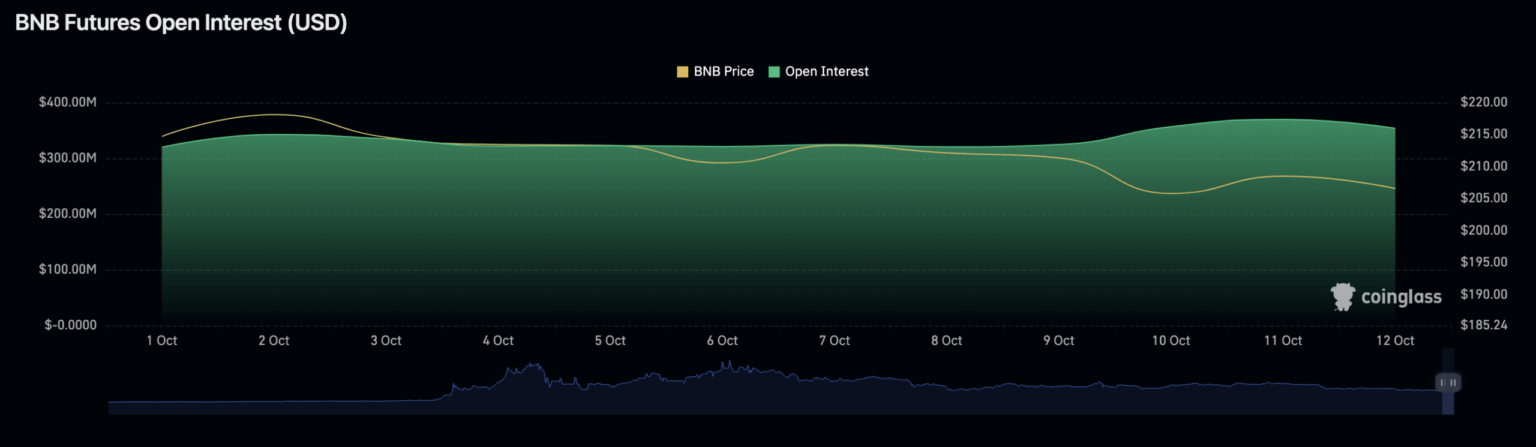

Because of its statistically vital correlation with Bitcoin [BTC], Binance Coin [BNB] has additionally seen a surge in its open curiosity for the reason that month started.

Life like or not, right here’s BNB’s market cap in BTC phrases

At $353.88 million at press time, BNB’s open curiosity has climbed by 11% since 1 October, information from Coinglass confirmed.

Supply: Coinglass

In a latest submit on X (previously Twitter), on-chain information agency Santiment famous that the expansion within the variety of unsettled contracts (futures and choices) associated to main property similar to BNB could possibly be an element within the present struggles of the cryptocurrency market this month.

🤑 The rising quantity of excellent futures & choices towards #Bitcoin could also be lending to #crypto‘s failure to launch right here in October. Rising open curiosity, significantly when $BTC begins seeing $7B or extra, typically indicators greed. For now, it sits at $6.19B. https://t.co/DHSaJGvQtI pic.twitter.com/zkE6qbDjN9

— Santiment (@santimentfeed) October 11, 2023

Concerning BTC, Santiment acknowledged {that a} surge within the coin’s open curiosity, particularly above $7 billion, is regularly indicative of heightened greed and is commonly adopted by a correction, which pulls down the coin’s worth.

The info supplier referenced BTC’s deleveraging occasion of 17 August, which prompted the main asset to report its most vital single-day sell-off of the 12 months. Between 17 and 18 August, BTC’s open curiosity recorded a 7% decline.

BNB up to now this month

At press time, the fourth-ranked crypto asset exchanged arms at $205.80. On a month-to-date, the altcoin’s worth has dropped by 4%, in response to information from CoinMarketCap.

Worth actions assessed on a 24-hour chart revealed that sellers initiated a brand new bear cycle on 9 October, which has since contributed to the falling decline for the asset.

A take a look at BNB’s Transferring Common Convergence Divergence (MACD) confirmed an upward cross-over of the sign line with the MACD line on 9 October, and the indicator has since been marked by crimson histogram bards.

When an asset’s MACD line journeys under the sign line, it’s interpreted as a bearish sign.

Moreso, at press time, the coin’s adverse directional indicator (crimson) at 22.11 rested above the optimistic directional indicator (inexperienced), which returned a worth of 12.74.

Learn Binance Coin’s [BNB] Worth Prediction 2023-24

When an asset’s Directional Motion Index (DMI) is about up on this method, it signifies that the sellers have stronger management of the market.

Lastly, BNB’s Relative Energy Index (RSI) and Cash Circulation Index (MFI) have been pegged under their heart traces at 38.21 and 35.29, respectively, at press time. This confirmed that coin distribution outpaced accumulation amongst BNB’s every day merchants.

Supply: BNB/USDT on TradingView