The Ethereum worth moved from buying and selling round $1,190 on January 01 to as excessive as $1,704 final week. Whereas the pump has been attributed to a number of components, whale merchants are mentioned to be behind the current crypto rally. Nonetheless, the extremely anticipated Shanghai improve that may allow withdrawals of staked ethers can also be an enormous issue within the current pump.

Nonetheless, the bulls have decreased their preliminary momentum with ETH costs down roughly 2.6 p.c prior to now 24 hours to commerce round $1,632. In line with a popularly used indicator, RSI, the Ethereum worth might right additional within the coming weeks as a falling divergence seems on an overbought instrument.

Ethereum Worth Beneath Whales Affect

In line with the on-chain analytic platform Lookonchain, a mysterious fund with over $10 billion has been making the Ethereum worth pump this 12 months.

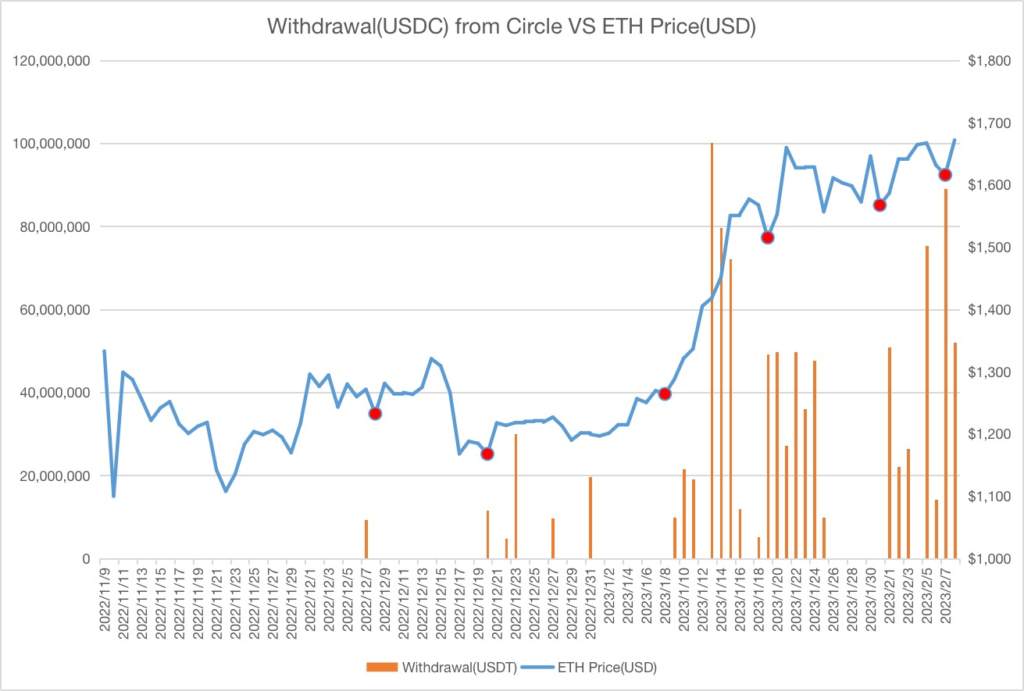

Reportedly, a collection of Ethereum transactions have been recognized headed to centralized exchanges like Binance, Kraken, and Coinbase prior to now month. Curiously, each time that the mysterious account made a major switch, the underlying Ethereum worth spiked.

The reported whale ETH dealer has been shifting thousands and thousands of money from Circle’s USDC to centralized exchanges.

Facet Notes

The Ethereum market might face regulatory upheaval from the USA Securities and Change Fee (SEC) ought to a report by Coinbase World CEO and Founder Brian Armstrong materializes. Reportedly, the U.S. SEC intends to ban crypto staking for retail clients.

Notably, the SEC is prone to argue that staking makes crypto initiatives safe and ought to be registered underneath the securities act. Consequently, Cardano’s chief known as Ethereum’s staking an issue for the whole crypto trade.