Many analysts have weighed on the potential trajectory of the flagship cryptocurrency, Bitcoin. This time, Bloomberg analyst Mike McGlone has highlighted the opportunity of Bitcoin value declining additional and when this might occur.

Bitcoin Worth May Decline Additional

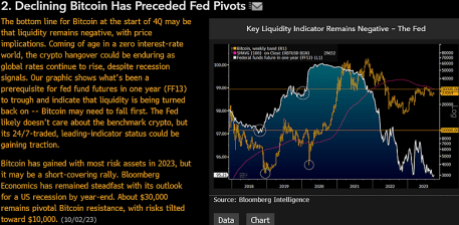

In a tweet on his X (previously Twitter) platform, McGlone famous that Bitcoin dangers declining to $10,000 (which might occur by year-end) because it continues to battle the $30,000 resistance stage.

This resistance stage has lengthy been touted as the important thing to a sustained breakout in Bitcoin’s value. Nevertheless, going by the evaluation that McGlone shared, the percentages appear to be in opposition to this occurring.

Bitcoin has risen considerably in 2023, contemplating that the crypto asset traded at round $16,000 in the beginning of the 12 months. However, McGlone warned that this can be a “short-covering rally.”

As a part of this evaluation, he famous that liquidity within the Bitcoin ecosystem remained adverse heading into the fourth quarter. This in the end means there may be extra promoting stress than shopping for stress, which might have an effect on Bitcoin’s value.

One other issue is the rising rates of interest. McGlone famous that Bitcoin gained prominence in a “zero interest-rate world” with better monetary freedom. However now, Bitcoin (alongside different cryptocurrencies) may proceed to endure a hangover as “world charges proceed to rise.”

World inflation is claimed to be on the rise, and to curb it, authorities are elevating rates of interest, which might limit spending and, by extension, the liquidity that goes into the crypto market.

In the meantime, the evaluation famous Bitcoin’s significance within the grand scheme of issues. Bloomberg Intelligence drew a correlation between the FED fund futures and Bitcoin’s value. In line with projections, Bitcoin wants to say no additional earlier than there is usually a liquidity reversal in these funds.

Whereas the Federal Reserve might not care about Bitcoin, he said that Bitcoin’s “24/7-traded, main indicator standing could possibly be gaining traction.”

BTC might fall to $10,000 | Supply: X

The Destiny Of The Broader Crypto Market

In one other tweet, McGlone famous that cryptocurrencies “may be leaning into recession.” To drive house this level, he highlighted the relation between the crypto and inventory market and said that the latter might succumb to an “ebbing tide” suppose the inventory market had been to expertise a “typical drawdown” on account of a recession.

Regardless of the “broader on-and-of-again fluctuations,” this projection is claimed to be mirrored within the “downward trajectory” of the Bloomberg Galaxy Crypto Index (BGCI) and Russell 2000 Index (RTY) from their all-time highs in 2022. Each markets have remained tepid and proceed to consolidate as they anticipate a “catalyst” that might spark a value surge.

This evaluation is just like that of crypto analyst Nicholas Merten, who, whereas drawing out the direct relation between each markets, famous that if the shares of massive tech corporations like Apple and Microsoft don’t begin selecting up, there could possibly be a “actually large downside” for the crypto market.

BTC value nonetheless holding above $27,000 | Supply: BTCUSD on Tradingview.com

Featured picture from Investor’s Enterprise Day by day, chart from Tradingview.com